MONTHLY HOUSEHOLD BUDGET UPDATE

For example, if you spend $125 on entertainment in January, $175 in February and $150 in March, at the end of March when you update your formula, your "Average" column will show that you are (so far) spending an average of $150 per month on entertainment. This column will simply total the amount of total spending you've done at the end of each month, divided by the number of months. To get an update each month on your personal financial situation, enter a formula in each category field in your "Actual" column that projects your annual spending, which you will update each month. Get the latest updates, offers and helpful financial tips. Add one more "Gain/Loss" row after the "Total" row with a formula that subtracts your total expenses each month from your total income, showing your monthly cash gain or loss.

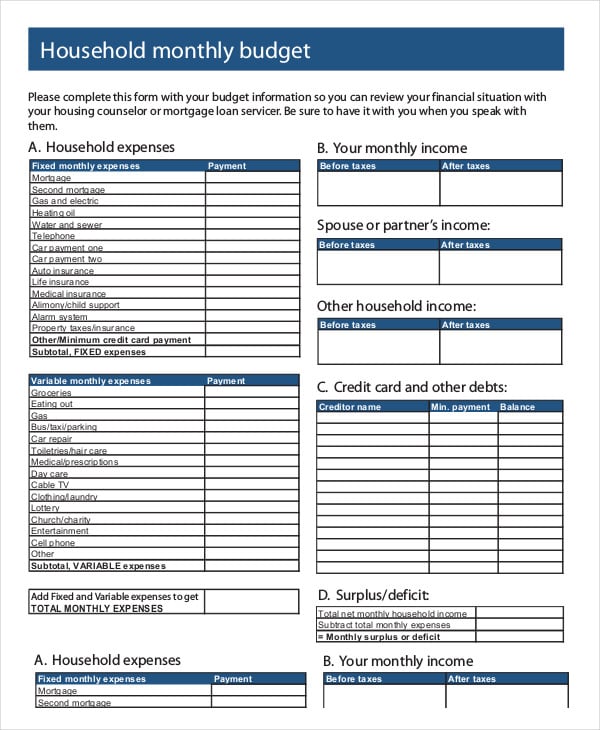

For example, if you spend $300 a month on groceries on average during the year, the "Annual" column will show $3,600 at the end of the year.Īfter your last expense category, create a "Total" row that adds up all of your expenses for each month and shows your total spending per month. After the "December" column, create an "Annual" column that tracks your total spending for each expense during the year. Before the "January" column, insert two more columns titled "Projected" and "Actual." In the "Projected" column, insert the amount you expect to spend each month on each category. Total Each Month's ExpensesĬreate a simple budget document in a spreadsheet by listing your expense categories down the first column and then enter the months of the year across a row near the top of the page. You might be surprised to see how much you're spending on discretionary categories, such as dining out, helping you find areas where you can spend less, save more or manage your credit better. This will give you a pretty good idea of what you'll spend each month during the coming year for these goods, services or debts. Write down the total amount you spent on each of the above categories last year, then divide the total by 12.

You'll also see any large annual expenses you need to budget for, such as holiday gifts. Last year's financial documents will show you other regular monthly payments you have, or quarterly or semi-annual payments you'll have, such as insurance premiums. Using last year's credit card and bank statements, you can see exactly what you spent last year on common expenses. You don't have to make wild guesses at what your spending will be this year.

To manage and improve your financial situation, you should create a dynamic budget that helps you spot trends, savings opportunities, and potential spending problems.Īdding a few extra columns and rows to a budget document lets you update your average spending and savings each month for better planning-letting you keep more money in your bank account. The best personal or household budgets are more than a simple list of monthly expenses.

0 kommentar(er)

0 kommentar(er)